America’s housing market is shuddering

For the country’s homeowners, the good times are coming to an end

Few pandemic-era bets will have paid off quite as nicely as nabbing a house in a boomtown such as Atlanta, Austin or Miami with a two-point-something percent mortgage rate—and holding on as its value soared in the subsequent years. People wanted sun, space and an escape from covid killjoys. These cities offered it.

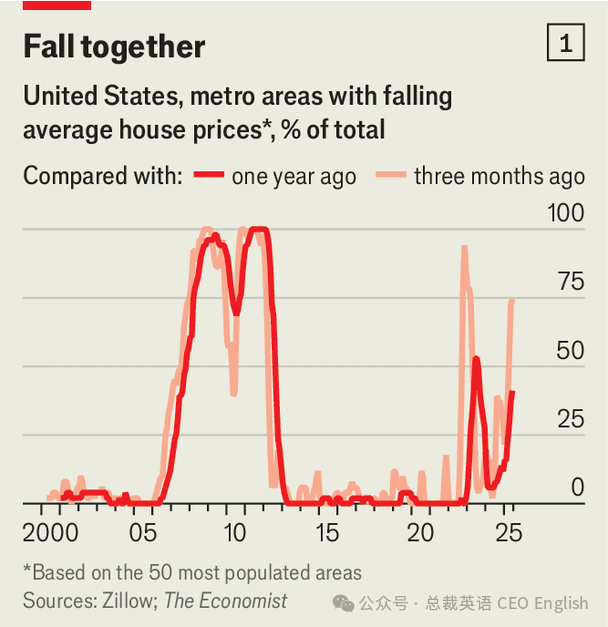

图表显示美国50个最大都会区中,房价下跌的城市占比。深红是同比,浅红是近三个月

Now, though, the good times are coming to an end. America’s housing market is flagging. Across the country, prices have drifted down in the first half of the year, with most cities seeing falls in the past three months (see chart 1). The Federal Reserve’s tight monetary policy has kept interest rates painfully high. And this is feeding through to the property market, just as President Donald Trump’s tariffs chip away at the economic growth that had been keeping sales strong.

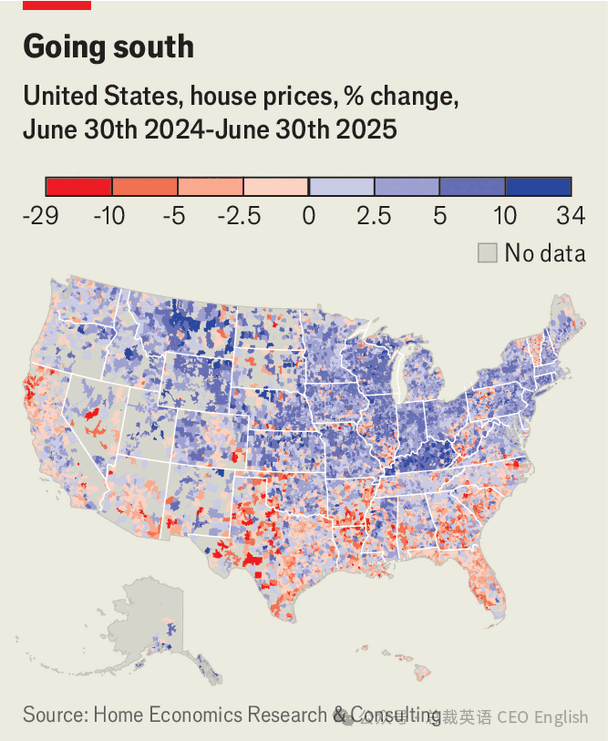

The pain is not evenly distributed. Prices are still creeping up in the north-east and the Midwest, while the west and, in particular, the south are hurting (see map). Pity the homeowner in Dallas or Phoenix who bought last year. They are carrying a beefy, 7% or so mortgage rate and the value of their house is already down a few percentage points in dollar terms, or more after accounting for inflation.

这张图展示的是过去一年美国房价的冷热地图:南部多个市场降温明显,而中西部、东北部和部分西北地区则依然在升温。

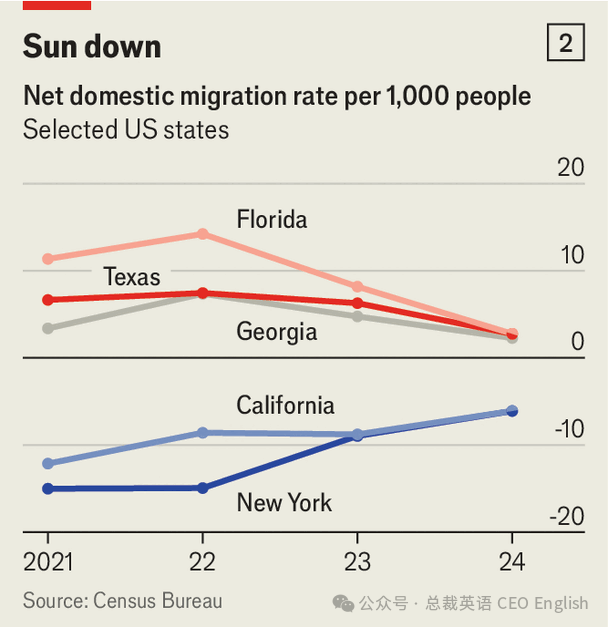

Such cities face a number of difficulties. Fewer Americans are upping sticks and moving to the sunbelt than during the pandemic, when internal migration jumped (see chart 2). Mr Trump’s crackdown at the Mexican border may be making a difference, too, by lowering the number of international arrivals. Housebuilding boomed in these cities a few years ago, when demand was high and rates were low. Although it has now slowed, many covid-era constructions are only just hitting the market. Worse still, the public perception of these cities has changed. Austin and Miami failed to attract enough superstar businesses when they were the flavour of the month; few tech bros today tout them as the new Silicon Valley.

For similar reasons, some of the worst-performing markets in the north-east are holiday towns, which also did well as demand from remote workers soared. House prices are falling in Nantucket, Martha’s Vineyard and along the coast of Maine. Big city suburbs, another pandemic beneficiary, do seem to be faring better—whereas dialling into Zoom from the beach house doesn’t quite work, modern hybrid work schedules perhaps make adding 15 or 30 minutes to the commute viable.

2021-2024年,佛罗里达、德州、乔治亚净迁入率下降,加州、纽约净迁出率减少。

The state that fares worst of all combines these trends and adds a few peculiarities of its own. It is Florida, where prices have fallen by 4% over the past year. Aziz Sunderji, an independent analyst, points to high and rising home-insurance premiums owing to climate change ($11,000 or so a year in Florida, versus $2,400 nationwide), a sharp drop-off in demand from well-off Canadians (a surprisingly large number of whom flee cold winters to Florida) and expensive new safety rules that came in after a condominium in Surfside, a Miami suburb, collapsed in 2021.

What does the shuddering market say about America’s economy? Historically, housing has been one of the most interest-rate sensitive sectors; buyers lever up to make purchases, and are less likely to do so when borrowing becomes expensive, dampening sales and new construction. The industry both helps drive economic growth—housing employs a lot of people and homes are a slug of many families’ net worth—and is worth watching to see where the economy is heading.

The current slowdown is partly deliberate: the Fed says it is keeping policy tight to squeeze out the last of America’s above-target inflation. Other parts of the economy are cooling, too: real private consumption and investment rose at an annualised rate of just 1.2% in the second quarter of 2025, having run at or above 2% for most of the past few years. And payrolls growth has slowed in recent months, even if that in part reflects lower migration.

Yet relief for the housing market, in the form of much looser monetary policy, may not be on the horizon (even if the Fed does look likely to lower rates a bit in the months ahead). Tariffs have complicated the job for policymakers, as they may cause inflation to spike. At the same time, a colossal build-out of artificial-intelligence infrastructure, data centres and the like is helping buoy growth. Capital spending by the “magnificent seven” big technology companies now accounts for over 1% of gdp, and has near-doubled in just a few years, according to Renaissance Macro Research, reducing the need to stimulate the economy. The past decade has been very kind to America’s homeowners. Perhaps aspiring buyers are due a break. ■